House prices

Some people love it - thank you!

Some people hate it - thank you too! I just wish you could come up with constructive feedback rather than low level insults. That way we could have a debate on specific topics. But I will not respond to these incredible insults, sorry.

There’s always haters in life, all one can do is to keep going.

On the topic of Afterpay and other buy now pay later providers - it is factually incorrect to call them ‘another credit card’. They are legally not classified as credit as they found loopholes in the National Credit Act. Article below provides a quality analysis on the topic.

https://www.smartcompany.com.au/industries/retail/legal-loophole-afterpay/

Because they are not classified as credit, consumers are not subjected to below things:

1) Background checks

2) Credit score checks

3) Income checks

So, someone with a terrible credit score and no income can gain access to easy credit. This is a problem in which Australia leads the world (or up the top somewhere). These providers have fought for years to be excluded from the credit classification. Admittedly, some do conduct credit checks when opening the accounts but overall governance is pretty loose and subjective to a specific provider.

Many consumer goods have repeatedly called for more regulation in the sector. This ABC article talks about in good detail, it’s a very good read.

https://amp.abc.net.au/article/100914440

I can see that the new finance minister wants to do something about it. I wish him the best of luck. My position is that more regulation is definitely required as the sector operates as Wild West at the moment.

Joshy2000 wrote:https://www.smh.com.au/national/our-bondi-pad-a-snapshot-of-generational...

Yes, this is a good article. I wrote about some of these issues previously, especially property being excluded from the CPI metrics. Well, it’s not entirely excluded but a huge chunk of it is excluded. This totally distorts the picture between the official numbers and real estate price pains people are experiencing in real life.

onya flollo...

"...On the topic of Afterpay and other buy now pay later providers - it is factually incorrect to call them ‘another credit card’. They are legally not classified as credit as they found loopholes in the National Credit Act. Article below provides a quality analysis on the topic..."

whilst you could argue - badly - its just another form of credit card... clearly they are not, as pointed out above...

anyway, the key point is neary everyone puts everything on credit now - including the flash new car on the home loan - thats a dramatic change in itself...

and many people are now contractors / small business / sole traders, so the whole of living expenses now goes on the credit card, for 'tax purposes' - rightly so or wrongly...

and the kids (< millenial) don't even know a world without credit cards and various scammish pay mechanisms ...back in the day, no one under twenty something even had a credit card, more like thirty somethings actually...

the point is the huge cultural shift, which has only really enriched a select few... and enslaved generations...

one can make this point and still have concern for generations to come, that have no choice but a massive home loan...

I see many of the after-pay like cunts are now going down... good riddence... and not a day too soon!

I will definitely pay those posts above Bonza and DX3. Most of the conditions you describe are accurate. Timing is everything. Think of the timing savers have been subject to over the last 15 years, though. It cuts both ways.

Timing (and location) also: who your family is, the situation they come from. Maybe there is no questioning of taking on a large debt load, as it has proven to be a winning strategy for most of the post WW2 era in Australia, thus an assumption it will continue to be so and action on that assumption, despite misgivings? Maybe other people hear their grandparents' stories of the repossessions of the Great Depression... the failure of the banks... timing of when you/your family are born and your perspective. When my father took his grandchildren into a sweet store in Port Fairy, tears came from his eyes, for the shelves were full, stocked to the ceiling. Obviously things were different when he was a kid. Hardly any adult in Australia presently has an experience like that to draw from (though we are beginning to see empty shelves). This is why I am so interested in hearing from others with a European postwar perspective, because I wish to see if it is similar to the stories I have heard from my family.

Good examination of Afterpay Flollo, you have outlined what it actually is.

Hey Flollo, would you be able to construct a CPI that actually includes housing?

and, I recently saw 'articles' celebrating jetstar or qantas offering after-pay for holidays to bali

that sort of shit is just plain madness

"Second, tens of thousands of home owners use their redraw facility for consumption. Drawing down from the mortgage, or “eating the house”, is a luxury for those watching their house prices go up, aggravates the relative disadvantage of those not able to do so, and contributes to the inflation that will now punish everyone equally, whether they own a house or not. Nice (lack of) work if you can get it."

from article, aggravates more than disadvantage. But has powered our economy.

After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.

I didn't read flollo's post as an indictment on today's non homeowners, more as a bit of a rark-up to all of us about not being cavalier about debt. And about going against the grain.

soggydog wrote:.I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.

I agree with the above. Do you think the young have shown they want to live less frugally, less instant. Or want to. Going to be very interesting watching this play out in an already dog eat dog world. Haves and have nots where image is all and above all. Psychologically I don't see this playing out much at all or positive change being taken onboard fast enough. Mental health in young people is through the roof.

Consumerism is encouraged and a mass movement until we see a forced economic social implication being applied (self made in this instance). Going with out is already upon some and is only going to get tighter. The social fall outs are already showing. Try telling that to some of the influencer crowd. Mummy and daddy can only do so much. $ten dollars a lettuce in some areas wtf. Save your pennies wisely if you can, Fuck the bad expendables off such as excess living it up if young. Become self sufficient as much as possible. Only going to get tighter in my opinion. We are watching a true class devide. Some never got a choice. Network with likeminded spirits and don't carry freeloaders. Know your worth. How much for a dog in the window? Youth of today are going to have to find a way. But what will be the fall out? And could we have prevented it?

Do you think there's a place on the forums for a self sufficiency thread? Beyond the garden thread that is, for that pre-supposes land (ownership - though there are collectives). Surely there are some gems of wisdom out there in the readership.

Could we have prevented it? Yep, if QE didn't exist, or really the 'Greenspan put' before this (these are US, but the economy is global and they act as a major source of funds and have outsize influence as we are seeing today) If lending standards were higher. If Aus housing policy was not so supportive after 1984ish. If the spirit of SKINS didn't exist. (Spend Kids Inheritance Now)...

What is to stop some young people just buying land in the middle of nowhere, establishing a town, allocating lots, and going their own way? With their own skillsets? Pioneer stuff. As big or as little residences as possible, land, food etc. Then saying FU to anyone who is older, already has a house, is wealthy etc etc (And soggydog, maybe common sense heavy, with a tip to the regulatory framework without being straightjacketed by it, used to work with building codes in mind too... Maybe build Amish style...)

Another thing is when things get really bad the black market explodes and all that comes with it. We know how we got here it's nothing new. We have encouraged it to a certain extent. Social issues. Australian made. Our kids.

Water mostly, and fertile soils and a climate that supports plants and animals.

And money, and people being able to get along as a collective.

I've seen a few goes first hand.

A Self Sufficiency thread is a great idea.

Just a little house price anecdote: Colleague of mine is only 30 or so, very quiet, very clever. When other colleagues his age whinge about everything, he just keeps mum and does his work.

He and his wife bought a house (Wellington, the world's most ridiculous housing market) years ago. Not the 'best suburb', but nice house. Managed to pay it off (no eating out, etc etc), and they're now working on their 'Fuck Off Money', so that thy can ditch their jobs when they need/want to.

Young people, expensive town, not in high-paying jobs. Not easy, and not for everybody, but doable. Impressive.

Interesting, I'd agree with the last one for sure FR , people do tend to find ways to disagree.

The thought came to mind as a Tasmanian town I worked in, way out of the way, had pretty much an entire town subdivided, but very, very few structures, and the prices were extremely affordable. Pre covid obviously.

With the Amish, you have the religious solidarity keeping the community together I guess.

Nice anecdote IB, it's possible!

Self sufficiency thread would be beaut, there's much to learn.

velocityjohnno wrote:Hey Flollo, would you be able to construct a CPI that actually includes housing?

Wow, a great challenge. I reckon I could. Well, mathematically, it's not some super complex formula, it's more about the availability of data that is being used. I'll dig around a bit and give it a shot. I will pull it off, at least under some assumptions.

Israeli farm practices have many benefits in farming in low yield places for any one interested. They are some of the leaders. Food production can be done resourcefully in most cases.

It's the is the set up and financing and collective effort where it gets hard. Many examples of success.

I think we are going to see massive social change in regards to resources and communal living arrangements. Finding a place for a tent is increasingly hard.

Government could rent parcels of land of farmers and provide a safer habitat for needy people. If people are ruffing it. Open up show grounds unused government building etc. many possibilities for the homeless or needy haven't be explored or encouraged partly because they are somewhat invisible to those who have.

Australia could provide safer safe refuge for people but has not made it a priority. Once system is under pressure other methods must be explored. Communities services can only do so much. Most ovals have a shower Block and a wc. Open them up. Show grounds can house people. So can sports grounds. We have to collectively want to change the increasing problems.

So many ideas Can be explored. It is endless and a failure. How many empty offices in the city. It's incredible we accept homeless unless it effects us directly.

Corporates sleep outside to raise money when they could be networking and bringing real change. Sleeping in a shit car is bad enough try doing that with two kids and as a single mum. Vulnerable is understatement.

The problem is not going away and will become more visible Australia wide. Action is needed urgently and with local and government leadership. Some will never own a home. But Australia can do so much better for our disadvantaged and desperate. Never forget it. Coming to a place near you and all that goes with inaction avoidance and repetition of past failure. Make no excuse.

Bit of a rant but this has been evolving for years. Im fucken tired of seeing it in the communities I am a part of. And the bullshit avoidance of those that could have made real change for those with considerably less. Be it opportunity or money. Every Australian can be given a safe place to sleep if in need if we actually made it a priority. Safety, shelter, security and a place to wash, When your desperate communal doesn't matter. Women and children first. New prisons are not housing. Can the real Australia please stand up? Social change starts with us.

soggydog wrote:After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.

To answer your question about people DIY their own houses; a short answer is no, that is not a good idea. Well, at least structural jobs + plumbing, and electrical should be done by professionals.

Now a bit more detail. The purpose of storytelling is to get people engaged. From what I can see in the thread - it worked. A good story gets people thinking and you can take whatever you want from it. Not everything is relevant to all the readers but hopefully, there's enough there to get people talking about some of the topics being discussed.

Let's imagine a myth about Icarus for a second. It survived for thousands of years and it's still being talked about today. Now, no one actually thinks that there was this guy called Icarus who flew too close to the sun. It's not about that but about the powerful lesson behind the story.

This is a fantastic link with some analysis on Icarus:

https://mahb.stanford.edu/blog/learning-from-icarus/#:~:text=Instead%2C%...'s%20learn%20the%20lesson,possible%20in%20a%20finite%20system.

I will just share a small paragraph here;

'Let’s learn the lesson that the myth of Icarus is supposed to teach: avoid hubris. Do not fly too high. Acknowledge limits exist, including the keystone limit that infinite growth is not possible in a finite system.'

So, the lesson from my story is not about building houses or anything specific like that. It's about the below:

- Frugality is a virtue

- Some cultures value it more than others

- Australia hardly puts any value on it, it's not really discussed or encouraged anywhere

- We are consuming way too much as a society and quite often using credit to get there

And in summary, that's it. Obviously, there was a bit more detail but on a high level, this is the essence of the story.

My 87 year old dad has just moved out of a unit he has been renting for 52 years in Sydney. Living on the third floor was getting too tough on the legs. He has moved in with my brother.

His parents never owned property and he was never been keen on debit. The fact he worked for himself I beleive made it not easy to get a loan also. He has been fortunate to have a good landlord who owned the whole block. ( the landlord now is the niece of the original one.) Just to show you can rent your whole life and be happy.

Its not a choice i have taken though.

“What is to stop some young people just buying land in the middle of nowhere, establishing a town, allocating lots, and going their own way? With their own skillsets? Pioneer stuff. As big or as little residences as possible, land, food etc. Then saying FU to anyone who is older, already has a house, is wealthy etc etc (And soggydog, maybe common sense heavy, with a tip to the regulatory framework without being straightjacketed by it, used to work with building codes in mind too... Maybe build Amish style...)

”

For the first bit, yeah maybe lots of money could be the hurdle.

Having building codes in mind is one thing, adhering to them is another, knowing what the fuck your doing is a major thing. Let’s not even talk about engineering or detail. Common sense of the diy’er is pretty much worth fuck all. Then you want to sell an almost always inferior product at market rates.

flollo wrote:soggydog wrote:After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.To answer your question about people DIY their own houses; a short answer is no, that is not a good idea. Well, at least structural jobs + plumbing, and electrical should be done by professionals.

Now a bit more detail. The purpose of storytelling is to get people engaged. From what I can see in the thread - it worked. A good story gets people thinking and you can take whatever you want from it. Not everything is relevant to all the readers but hopefully, there's enough there to get people talking about some of the topics being discussed.

Let's imagine a myth about Icarus for a second. It survived for thousands of years and it's still being talked about today. Now, no one actually thinks that there was this guy called Icarus who flew too close to the sun. It's not about that but about the powerful lesson behind the story.

This is a fantastic link with some analysis on Icarus:

https://mahb.stanford.edu/blog/learning-from-icarus/#:~:text=Instead%2C%...'s%20learn%20the%20lesson,possible%20in%20a%20finite%20system.

I will just share a small paragraph here;

'Let’s learn the lesson that the myth of Icarus is supposed to teach: avoid hubris. Do not fly too high. Acknowledge limits exist, including the keystone limit that infinite growth is not possible in a finite system.'

So, the lesson from my story is not about building houses or anything specific like that. It's about the below:

- Frugality is a virtue

- Some cultures value it more than others

- Australia hardly puts any value on it, it's not really discussed or encouraged anywhere

- We are consuming way too much as a society and quite often using credit to get there

And in summary, that's it. Obviously, there was a bit more detail but on a high level, this is the essence of the story.

One of my points was regarding frugality. And this is just a thought that could be explored and discussed further.

I’ll use the arts as an example. The arts as a whole in Australia is a bigger employer than the fossil fuel industry. So say young people trying to break into the housing market all take heed of the lessons of previous generations, have a cultural change and stay home and don’t go out and take advantage of their youth. That’s a huge financial blow to an entire industry, that is extremely important to a healthy robust society. Many of those employed in the arts then fall on tough times, hospitality which is also often an entry level job for young people suffers also. Like I said on this one these are just thoughts I had.

So while I recognise that frugality is a good tool for individuals to have, what would the economy look like if there was a strong cultural shift in that direction. And are we about to find out.

And I agree with much of what you have said flollo

It’s not hating or insulting on you flollo. It’s pointing out the bullshit babble you are printing. Fuck me the bubble that some are commenting on from on here. Where have you guys been. Those rules don’t exist for the non home owner generation/s. There is a inequality crisis. It’s worsening. It exists because your neocon free marketers you keep voting for made it so. You sound so smart flollo but it’s pretty fucking simple. Neg gearing. capital gains. grants for home buyers and unsustainable immigration. How would you vote on each matter? Unless it’s an complete get in the bin on each you are just another vested preacher full of irrelevant advise for the bottom feeders.

soggydog wrote:flollo wrote:soggydog wrote:After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.To answer your question about people DIY their own houses; a short answer is no, that is not a good idea. Well, at least structural jobs + plumbing, and electrical should be done by professionals.

Now a bit more detail. The purpose of storytelling is to get people engaged. From what I can see in the thread - it worked. A good story gets people thinking and you can take whatever you want from it. Not everything is relevant to all the readers but hopefully, there's enough there to get people talking about some of the topics being discussed.

Let's imagine a myth about Icarus for a second. It survived for thousands of years and it's still being talked about today. Now, no one actually thinks that there was this guy called Icarus who flew too close to the sun. It's not about that but about the powerful lesson behind the story.

This is a fantastic link with some analysis on Icarus:

https://mahb.stanford.edu/blog/learning-from-icarus/#:~:text=Instead%2C%...'s%20learn%20the%20lesson,possible%20in%20a%20finite%20system.

I will just share a small paragraph here;

'Let’s learn the lesson that the myth of Icarus is supposed to teach: avoid hubris. Do not fly too high. Acknowledge limits exist, including the keystone limit that infinite growth is not possible in a finite system.'

So, the lesson from my story is not about building houses or anything specific like that. It's about the below:

- Frugality is a virtue

- Some cultures value it more than others

- Australia hardly puts any value on it, it's not really discussed or encouraged anywhere

- We are consuming way too much as a society and quite often using credit to get there

And in summary, that's it. Obviously, there was a bit more detail but on a high level, this is the essence of the story.

One of my points was regarding frugality. And this is just a thought that could be explored and discussed further.

I’ll use the arts as an example. The arts as a whole in Australia is a bigger employer than the fossil fuel industry. So say young people trying to break into the housing market all take heed of the lessons of previous generations, have a cultural change and stay home and don’t go out and take advantage of their youth. That’s a huge financial blow to an entire industry, that is extremely important to a healthy robust society. Many of those employed in the arts then fall on tough times, hospitality which is also often an entry level job for young people suffers also. Like I said on this one these are just thoughts I had.

So while I recognise that frugality is a good tool for individuals to have, what would the economy look like if there was a strong cultural shift in that direction. And are we about to find out.And I agree with much of what you have said flollo

soggy so much of what you are saying is all ready evident in regards to young people. Absolute shame regarding the arts

soggydog wrote:flollo wrote:soggydog wrote:After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.To answer your question about people DIY their own houses; a short answer is no, that is not a good idea. Well, at least structural jobs + plumbing, and electrical should be done by professionals.

Now a bit more detail. The purpose of storytelling is to get people engaged. From what I can see in the thread - it worked. A good story gets people thinking and you can take whatever you want from it. Not everything is relevant to all the readers but hopefully, there's enough there to get people talking about some of the topics being discussed.

Let's imagine a myth about Icarus for a second. It survived for thousands of years and it's still being talked about today. Now, no one actually thinks that there was this guy called Icarus who flew too close to the sun. It's not about that but about the powerful lesson behind the story.

This is a fantastic link with some analysis on Icarus:

https://mahb.stanford.edu/blog/learning-from-icarus/#:~:text=Instead%2C%...'s%20learn%20the%20lesson,possible%20in%20a%20finite%20system.

I will just share a small paragraph here;

'Let’s learn the lesson that the myth of Icarus is supposed to teach: avoid hubris. Do not fly too high. Acknowledge limits exist, including the keystone limit that infinite growth is not possible in a finite system.'

So, the lesson from my story is not about building houses or anything specific like that. It's about the below:

- Frugality is a virtue

- Some cultures value it more than others

- Australia hardly puts any value on it, it's not really discussed or encouraged anywhere

- We are consuming way too much as a society and quite often using credit to get there

And in summary, that's it. Obviously, there was a bit more detail but on a high level, this is the essence of the story.

One of my points was regarding frugality. And this is just a thought that could be explored and discussed further.

I’ll use the arts as an example. The arts as a whole in Australia is a bigger employer than the fossil fuel industry. So say young people trying to break into the housing market all take heed of the lessons of previous generations, have a cultural change and stay home and don’t go out and take advantage of their youth. That’s a huge financial blow to an entire industry, that is extremely important to a healthy robust society. Many of those employed in the arts then fall on tough times, hospitality which is also often an entry level job for young people suffers also. Like I said on this one these are just thoughts I had.

So while I recognise that frugality is a good tool for individuals to have, what would the economy look like if there was a strong cultural shift in that direction. And are we about to find out.And I agree with much of what you have said flollo

soggy so much of what you are saying is readily evident in regards to young people. Totally noticeable within the industries you are mentioning. Quite sad seeing it effected as such. Totally agree with those points that are usually the first to be sacrificed regarding cuts. The question is can they recover? And what are the costs to a progressive society. Long term short term. Money has been pulled to finance other needs but at what impact remains to be fully seen. Humans are quite resilient so hopefully it evolves and survives in some sense. Or we all stay home and watch pay TV force fed. Entertainment will be a luxury in some sense rather than a social outlet or composure of ideas artistically speaking of current levels.

One thing people need to let go of is the idea that We the People have any say in what’s going on without all picking up a pitchfork and burning it all down. Although even that would never work.

Australians haven’t ended up in this situation by voting in the wrong party or by any political misstep. We are, all of us, victims in a global culture war.

Blaming Scomo and Albo is like slaves blaming their plight on the overseer who cracks the whip without wondering who’s paying the overseer’s wages. Doesn’t mean the overseer is a nice, misunderstood person but it does mean they aren’t inherently responsible for the reason you’ve got a whip coming down between your shoulder blades.

Democracy as we know it is a sham.

A good series blowin thanks for putting it up

I have more faith than you DSDS. I have hope we can have meaningful visionary policies once again.

Times have changed along with peoples expectations. Back when I had a mortgage all you had to have was a small tv, a stereo and a land line telephone. You drove an old shit box and used public transport to go to work. Dunlop volleys were cool and we even made our own legropes and recycled the toe jam wax on our boards. I took sandwiches to work for 40 years and have never bought a cup of coffee or bottle of water in my life. With 17% interest rates it was often joked that after 5 years you were lucky to own the front door knob.

The young dudes at work must spend $150 p/w at the deli and all drive massive new 4x4s and subscribe to multiple streaming services and line up for every new

i phone and gaming console that hits the market. Slaves to being cool and even dress and talk like gangster rappers. They don't seem to understand that all these small self indulgent purchases add up and then whinge about not being able to afford to buy a house and the cost of living and blame everyone but themselves Go figure. Its about time people got back to basics . Cheers.

Abc news

https://www.abc.net.au/news/2022-06-12/nightclubs-in-decline-as-millenni...

https://www.abc.net.au/news/2022-06-12/austral-homes-without-sewerage-so...

https://www.abc.net.au/news/2022-06-06/youth-crime-juvenile-offenders-po...

https://www.abc.net.au/news/2022-06-12/victorian-public-housing-big-buil...

https://www.abc.net.au/news/2022-06-12/70yo-living-in-car-finds-temporar...

bonza wrote:It’s not hating or insulting on you flollo. It’s pointing out the bullshit babble you are printing. Fuck me the bubble that some are commenting on from on here. Where have you guys been. Those rules don’t exist for the non home owner generation/s. There is a inequality crisis. It’s worsening. It exists because your neocon free marketers you keep voting for made it so. You sound so smart flollo but it’s pretty fucking simple. Neg gearing. capital gains. grants for home buyers and unsustainable immigration. How would you vote on each matter? Unless it’s an complete get in the bin on each you are just another vested preacher full of irrelevant advise for the bottom feeders.

Bonza, out of curiosity, have you read all the content that gets shared in this thread? I wrote a lot about all the things you are mentioning. I was pretty clear with calling out negative gearing as a bad policy. I was also very clear about the benefits of public housing. And I also clearly shared practical ideas and example of redirecting the existing schemes into programs that develop property solely for the first home home buyers so they don’t need to compete with the rest of the market. I backed all the claims with credible references.

I can’t possibly share all that again, it’s somewhere at the back. You can go and read it if you feel like it.

There is no ideology behind any of this. The only ‘ideology’ I believe in is the law of mathematics. And it’s mathematically correct that when it comes to the property, the government subsidises both sides of the equation when first home buyers compete with investors. This makes no sense so the reasons must be political. It is also mathematically correct that someone who I don’t know bought a house for $800k and sold it for $1m will pay significantly less tax on $200k profits than if you earn those same $200k through income. So, of course, many are loading into the property. This makes no sense whatsoever so the reasons for such policies again, must be political.

I’m strongly against these policies as they make no mathematical sense. What more do you want me to say?

Also, we discussed all sorts of stuff in this thread and many topics had nothing to do with housing. You could split this into 5 different threads. Not all is relevant and definitely, not all that was discussed would have anything to do with addressing the housing crisis.

You are trying to paint the picture that doesn’t exist. You are welcome to continue to do so if it works for you. And I will keep analysing topics discussed on case by case basis. And at the end of the day, we’ll probably disagree on many things. And that’s ok.

A very well written and articulated article.

https://thenewdaily.com.au/finance/finance-news/2022/06/09/inflation-stu...

Whilst not directly related to housing certainly begs the question are the RBA forcing us into a recession for no god damned good reason?

flollo wrote:soggydog wrote:After reading flollo’s story regarding his grandparents I think there are some valuable points in regard to saving and avoiding credit. And talking to my own mother yesterday about my parents saving and frugality when purchasing their own first home. A condemned house that cost $15000. I wonder if this will work in today’s economy given that a large proportion of our work force are employed in service industry. If energy prices and labour costs mean that manufacturing moves increasingly off shore and everybody becomes an extremely frugal do it yourself’er what happens to the economy then.

If young people, a large percentage of the population all of a sudden stops engaging in consumer spending what happens to those jobs and the ability of those people to save for a house.

Building your own house is a great idea, but as a carpenter who has seen the quality of product the DIY brigade puts out do we then have to have different tiers to house pricing? And what knowledge and adherence to standards, codes of practice and engineering do the DIY’ ers bring to the structure they build while trying to penny pinch through the process.

Most of you guys have a far greater knowledge of the ins and outs than I do. But after reading some of the comments these are the questions I was left with.To answer your question about people DIY their own houses; a short answer is no, that is not a good idea. Well, at least structural jobs + plumbing, and electrical should be done by professionals.

Now a bit more detail. The purpose of storytelling is to get people engaged. From what I can see in the thread - it worked. A good story gets people thinking and you can take whatever you want from it. Not everything is relevant to all the readers but hopefully, there's enough there to get people talking about some of the topics being discussed.

Let's imagine a myth about Icarus for a second. It survived for thousands of years and it's still being talked about today. Now, no one actually thinks that there was this guy called Icarus who flew too close to the sun. It's not about that but about the powerful lesson behind the story.

This is a fantastic link with some analysis on Icarus:

https://mahb.stanford.edu/blog/learning-from-icarus/#:~:text=Instead%2C%...'s%20learn%20the%20lesson,possible%20in%20a%20finite%20system.

I will just share a small paragraph here;

'Let’s learn the lesson that the myth of Icarus is supposed to teach: avoid hubris. Do not fly too high. Acknowledge limits exist, including the keystone limit that infinite growth is not possible in a finite system.'

So, the lesson from my story is not about building houses or anything specific like that. It's about the below:

- Frugality is a virtue

- Some cultures value it more than others

- Australia hardly puts any value on it, it's not really discussed or encouraged anywhere

- We are consuming way too much as a society and quite often using credit to get there

And in summary, that's it. Obviously, there was a bit more detail but on a high level, this is the essence of the story.

@flollo

I really loved the story on the other page about you grandparents ect, one of the best post I've seen on here forever.

I understand where you are coming from having grandparents from Europe(England/Wales & Holland) that went through wars and truly hard times and brought that real hardworking D.I.Y and frugal aspects to Australia, that was also installed in my parents and then me.

But i still don't think how matter how frugal young people are it would be just as hard to get into the housing market in most areas and even if everyone started being frugal all it would do is create more demand and push prices higher (if possible)

But yeah for those that are frugal and think outside the box, especially if they have a D.I,Y attitude there is still much opportunity.

bonza wrote:I You sound so smart flollo but it’s pretty fucking simple. Neg gearing. capital gains. grants for home buyers and unsustainable immigration.

If it's that simple , then why is it a problem seen all around the developed world and even more and more in developing countries?

The main three aspects to me are:

1. Credit: So many more options today and our attitudes have changed towards credit, it is basically a must and we generally borrow to the limit of what we can.

2. Interest rates: Historic low interest rates not just in Australia

3. Demand & supply: Increasing demand for a limited resource and a resource that has more limitations on it than ever like zoning etc and just a slow trickle of new land releases.

Of course there is whole list of other things that only fuel things further but again countries all around he world are having similar issues that don have the things you list.

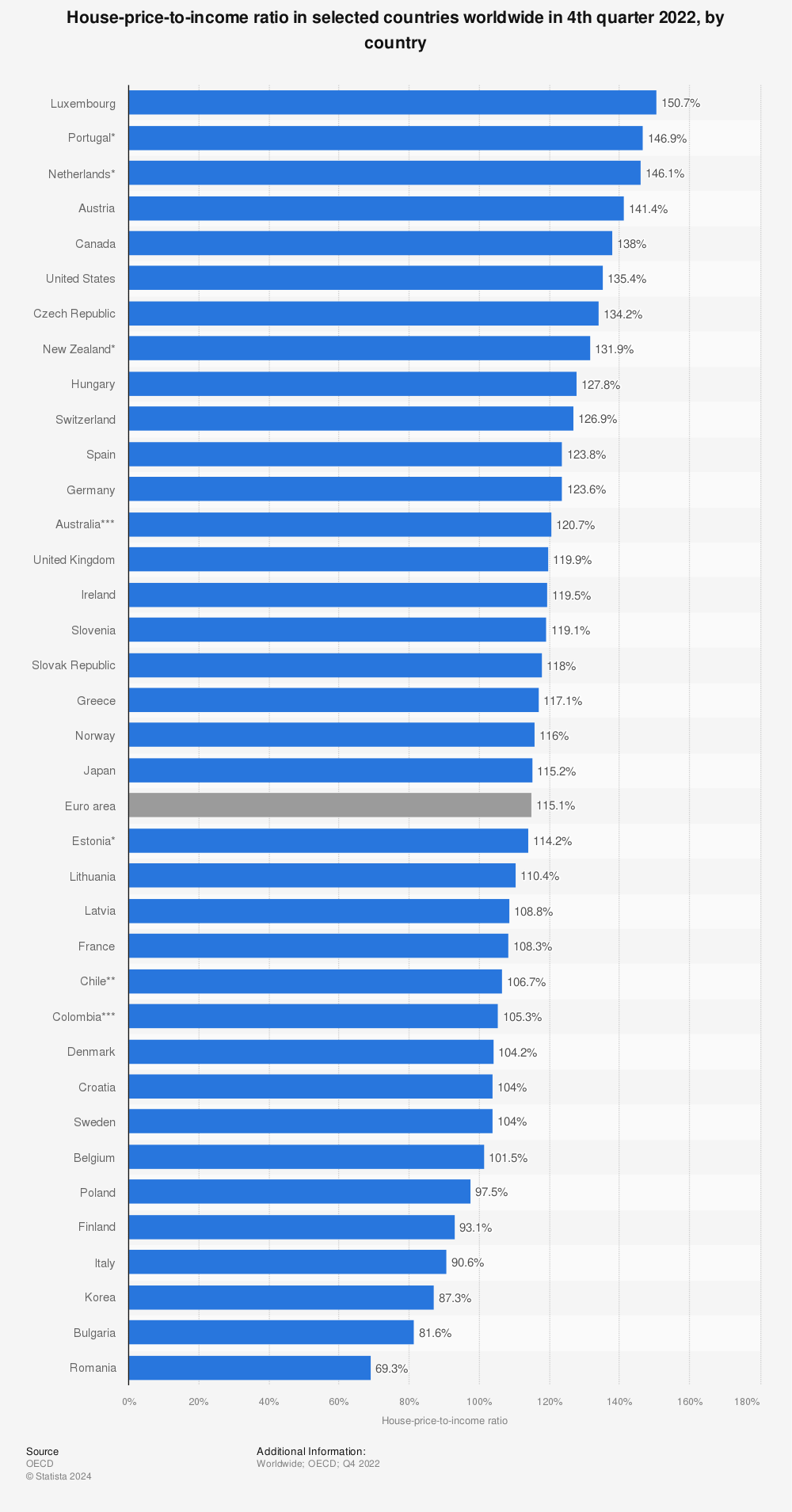

Lots of good posts above. Here are some comparative figures.

Find more statistics at Statista

Regarding frugality - I’ll say it again. It was a post regarding attitude towards consumption and debt across different cultures.

It was not an advice on how one should go about buying a house. Obviously, more cash in the pocket more chance one has to buy a house if that’s a priority. For some it is, for some it’s not. But it’s not some silver bullet systematic solution. Many different topics are being discussed under this thread, some quite relevant to housing some not relevant at all. Take what you like from it and apply it to your subjective situation.

for those that think the myth of icarus is somehow useful in illuminating our current situation...you might want to read the rest of the myth that leads to icarus and his father having to fashion wings.

so, the evil minotaur was stalking the lands of Crete. Daedalus, father of Icarus laboured many years to contain the minotaur by building the labyrinth of Crete. But, for all his labours, Daedalus only ended up trapping himself and son in the labyrinth with the minotaur. to escape the labyrinth, he built wings for himself and son icarus.

So, the lesson of this myth...not the folly of hubris, but the hollow returns of labour. you labour to escape destruction, but you are trapped by your own labour and lose your own son in an attempt to escape from your self-made prison.

blackers wrote:Lots of good posts above. Here are some comparative figures.

Find more statistics at Statista

I don’t understand this chart. 115%? A house costs 115% of which income?

@chook re the Icarus myth - Lets continue with this ...so Icarus taking off with the beeswax fastened wings flies too close to the sun (borrows imprudently), wax melts ,wings fall off, and fatally crashes to earth (looses house possessions etc). Rest of the world goes about its toil (paying off the debt) mostly impervious to the individual tragedy of poor Icarus. You can see this in the painting by Bruegel "Landscape with the fall of Icarus" See his splash down as a small image in the landscape , others largely unaware.

https://www.etsy.com/au/listing/643640879/pieter-bruegel-the-elder-lands...

It is showing the change in house prices relative to. Income using 2015 values as a baseline - “Ratio of prices to income per person after tax. 2015 equals 100.”

https://www.statista.com/statistics/237529/price-to-income-ratio-of-hous...

as I was saying before, many small businesses now live off 'the company' credit card... its becoma force of habit

which is fine when the dollars are flowing...

however, i suspect many tradespeople and the like, have developed bad habits, that may face some roosting chickens in these fast developing tighter times...

combined with locked in contracts suffering from spiralling materials supply costs; a general tightening of margins; falling house prices; a propensity to develope / gear up multiple investment properties; ...and a tax man that may have signalled a false sense of security...

I reckon the building industry (the smaller end) is in for a huuuuge reckoning... that's a donald trump style huuuuuuuge...

"Where can the ATO find that money? By following the Hiluxes. That’s right, the biggest sector that owes money to the taxman is tradies (and developers). Construction. They owed a staggering $7.22 billion in the 2020 fiscal year, as the next chart shows. If the ATO got that back we could pay for about half of one of our new nuclear submarines."

https://www.news.com.au/finance/money/tax/the-construction-sector-owes-a...

...might actually be able to pick a not so overpriced hilux soon... clouds... silver linings...

ah, jeez. once again...you left out the rest of the myth in your anachronistic re-interpretation.

H2O wrote:@chook re the Icarus myth - Lets continue with this ...so Icarus taking off with the beeswax fastened wings flies too close to the sun (borrows imprudently), wax melts ,wings fall off, and fatally crashes to earth (looses house possessions etc). Rest of the world goes about its toil (paying off the debt) mostly impervious to the individual tragedy of poor Icarus. You can see this in the painting by Bruegel "Landscape with the fall of Icarus" See his splash down as a small image in the landscape , others largely unaware.

https://www.etsy.com/au/listing/643640879/pieter-bruegel-the-elder-lands...

sypkan wrote:as I was saying before, many small businesses now live off 'the company' credit card... its becoma force of habit

which is fine when the dollars are flowing...

however, i suspect many tradespeople and the like, have developed bad habits, that may face some roosting chickens in these fast developing tighter times...

combined with locked in contracts suffering from spiralling materials supply costs; a general tightening of margins; falling house prices; a propensity to develope / gear up multiple investment properties; ...and a tax man that may have signalled a false sense of security...

I reckon the building industry (the smaller end) is in for a huuuuge reckoning... that's a donald trump style huuuuuuuge...

"Where can the ATO find that money? By following the Hiluxes. That’s right, the biggest sector that owes money to the taxman is tradies (and developers). Construction. They owed a staggering $7.22 billion in the 2020 fiscal year, as the next chart shows. If the ATO got that back we could pay for about half of one of our new nuclear submarines."

https://www.news.com.au/finance/money/tax/the-construction-sector-owes-a...

...might actually be able to pick a not so overpriced hilux soon... clouds... silver linings...

A couple of thing on this. Yes, this is true. During the last few weeks the ATO said they are will start chasing this money so all sorts of issues might come out of it.

A clarification on the revenue side for the government. From the accounting perspective this money would already be recognised as revenue and should be accounted for in the budget (as liability already exists). However, cash itself was never received which has negative impacts on the cash flow statement.

Government would be correct to have plans of using this revenue for whatever programs they want to use them for. But they might be short of cash when it actually comes to paying for whatever they want to do.

So, they are faced with 2 basic options (there are others but let’s keep it simple):

- Get more aggressive with debt collection

- Borrow money to cover the cash gap

I don’t have a clear opinion on what’s right or wrong and at what times. But in essence, this is the situation we are in.

old-dog wrote:took sandwiches to work.

The young dudes at work must spend $150 p/w at the deli and all drive massive new 4x4s and subscribe to multiple streaming services and line up for every new

i phone and gaming console that hits the market. Slaves to being cool and even dress and talk like gangster rappers. They don't seem to understand that all these small self indulgent purchases add up. .

Totally agree with the above. See this allot, expensive phones and fuck all else. Pretty nuts. Commercialism and consumerism has had such an impact on some. But I guess thats is also a successful business model. Cost is not considered enough eg $90 cotton hoodie, kids on $6000 mountain bikes, top of the line stuff with no understanding or respect for things etc. Stuff that is way overpriced for what it actually is. Crew are being taking advantage of and allowing themselves to be exploited in some circumstances. Don't get me started on the cost of beer especially craft. Its become a bit of a joke. Apprentices with larger loans and credit that haven't used it wisely and have nothing to show for it. Some can't even look after what they have acquired. Throw away society until consequence bites. The thirst for all new is insatiable but can they afford it?

Nothing wrong with earning your keep, and spending it as they wish but prioritise the the basic priorities. Money never grew on trees as some were lead to believe. Ignorant or mislead. Totally understand that it also hard to get ahead for those that have done the right things too or have some luck. Is basic budgeting taught in school or is it just an acquired app these days. Insane in some regard. A blank skateboard rides as well as a signature model.

For the guys above calling for more for the Arts - are you nuts? I would not wish the employment outcomes on the extra kids you'd put through that system - and I'm an Arts graduate. In Australia, carpentry has been a better choice - otherwise, it's off to London where work exists in the field, go do a 2nd degree, get into govt (22 jobs, 4000 applicants I do remember back in the 90s) or work whatever you can find. Wouldn't wish it on the kids, you'd be giving them an employment disadvantage to satisfy your desire for a more artsy society. Australia is different, it's a far more practical and building stuff society. I guess the outcome will make the graduate more frugal though. Back after 2009 the car industry had 500Mn taken from it's support, and the arts got 500Mn support iirc. We had fire twirlers come to town and that looked mint on that night. But I'd much rather have a domestic car industry.

"Totally agree with the above...."

I agree too, ...but I'm scared to admit it, because you get accused of being a privelaged old grump for denying someone a piece of avocado toast...

my olds are a prime example too, homemade sandwices everyday for work lunch - no exceptions; second hand cars their whole lives - until retirement, when they got their first (very modest) new one; second hand furniture; NO designer clothes... none!; etc. etc.

and, always scrimping and saving to pay off the house - and that was the 'best thing they ever did" ...freeing themselves of that burden early...

interesting that many crew in the modern context may never feel such freedom...

yes house prices are now totally ridiculous, and yes, now there is little hope without a huge loan...

but people's lifestyles have changed in a phenomenal manner through this time period... 12 year old kids with $1000s of dollar phones is just next level nuttery, but many just see this as 'normal'...

$6 coffees, brand new fourbys, manicures, botox, multple overseas holidays a year etc. are now just routine for many crew... and this is just the young young crew, not the people that have worked all their lives...

the expectations are just next level

yes we may have developed a 'services' economy, but if its all been built on a flimsy card house of credit... what have we actually achieved?

and if the card house falls ....really really falls... who is going to pick up the bill for all this outstanding credit?

it kind of all comes back to 'producer economies' versus 'consumer economies' ... which may be a little commy in its thinking... but geez ...we really went all in on this consumer economy thinking...

not a very 'balanced portfolio'

plain bloody reckless!

"For the guys above calling for more for the Arts - are you nuts?"

yep

funny how when scotty put up fees, it was all... "purely ideological"

is it not exactly the same to advocate the other way?

sure seems that way...

and, in the interests of disclosure...

I enjoy my $6 coffees

and I quite enjoyed my arts degree too

(when I finally finished the fucker!)

but none of it was on credit, and the very modest parts of my life have given me just as much worth and value...

Im a DIY guy...

and not much has fallen down.. yet...

resale value? ...non existent...

satisfaction and 'sustainability' ...through the roof!

velocity

I have supported the arts my whole life where and when I can afford too because it's an interest and an outlet from the rigours of life, I believe the arts create a healthier society and help form and celebrate societies culture. I fully understand your economic points regarding supply and demand and true employment outcomes within the arts . The arts have never provided for all within them financially speaking, lot's of broken un achieved dreams so to speak. But many who are passionate persevere to positive outcomes despite the difficulties.

Those that make a lifetime financing themselves are very good or have some luck. Just like pro surfers who have made it comfortably. It is the diminishing sphere of the arts in general that concerns me and the effect this has culturally more to speak. Trades have always been a secure job option again regarding supply and demand but even they are now facing problems.

There is still allot to play out and this and the fallout are my main concerns for young people, especially for those trying to get ahead. Everything has been effected, across the generations. I don't have the anserw's but it has been heading this way for some time. Houses that are not even close to the sums they are being sold for regarding materials used and construction costs. Over pricing of location most certainly has accelerated this. There has been a demand to the extent of exhausted supply so the market certainly hasn't been weak, rather the financial devide which has left many behind. Realities of balance that seems well out of hand to many Australians currently. Time will reveal the full extent of problem over the long term. Sad to see Australia this way. But I guess it's always was and will be anything for a buck right.

The arts will reinvent themselves as they always do, it's just a shame they are carved up at an expense to society as a whole. I believe we are weaker without them. Art has no bounds in it purest sense I would like to believe. Hold tight. And fuck those pokies off that saturate spaces that once where healthier by and large. We don't need anymore bottle'os and gaming rooms and the problems they bring. True vultures of hope but an easy short term sedative to the real problems people are facing.

I just want to add as a possibility in regards to the decriminalisation laws in the ACT and maybe soon to be seen in other states. That some thing of the majority of prisoners in incarceration is drug and alcohol related. Decriminalisation to some extent has had positive outcomes in other countries but will it be used to nullify the current social issues facing us by governments. I totally support the decriminalisation in regards to how wide spread it is through Australian society but it is a major disruptive socially speaking in some instances. Plenty of us know crew who have fallen to addiction suicide etc.

Both government and elements of society have done very well financially from its illicitness at the destruction of often those that can least afford it on some terms. Is there an economic or political reason for these sudden new decisions from a state that has previously had strict and tighter laws facing common drug laws? Just a thought I had reading posts and the current economic situation and past evidence. I believe in decriminalisation but health support is essential as is looking at it from a realistic view. So many things are starting to bite and play out. Hence why honest, positive and productive change is so important on the path in which Australia evolves or devolves. Can we de complicate the issues we face, are we able? Are we seeing people expressing concern through the last election, I reckon we are and this is just the beginning of generational change and approach to some what. House prices are a major player at current prices.

“And it’s mathematically correct that when it comes to the property, the government subsidises both sides of the equation when first home buyers compete with investors“

That doesn’t even make sense. It’s mathematically bullshit.

Pop quiz.

Yes or no. No “maybe” allowed

1.Negative gearing

2.Capital gains tax

3.Annual immigration >80k

4.Grants and incentives

If you read the whole thread as you say it’s why I’ve kept the list succinct

Thanks flollo

House prices - going to go up , down or sideways ?

Opinions and anecdotal stories if you could.

Cheers